How does Lyft's liability coverage work?

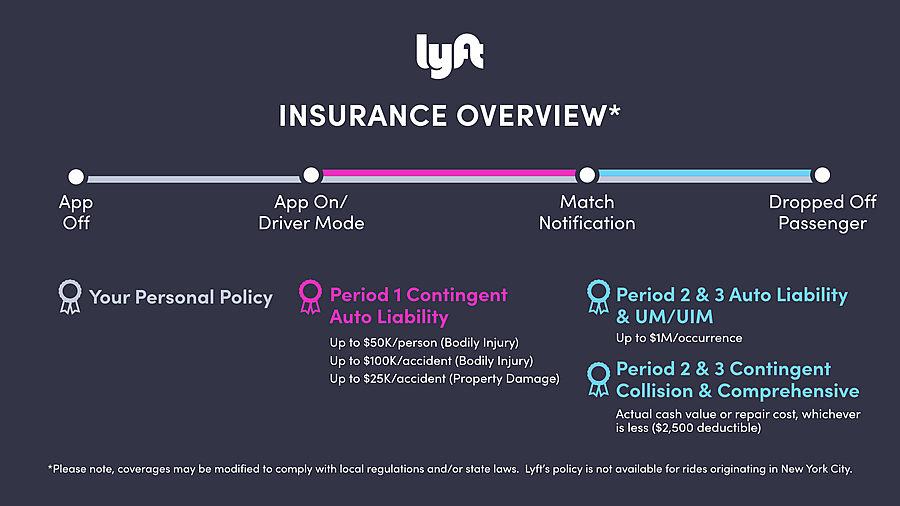

Driver mode off:

Your personal insurance is your insurance policy.

Driver mode on but not yet accepted a ride:

Lyft provides Contingent Liability to protect you if your personal insurance doesn’t.

How does contingent liability coverage work?

Our contingent liability coverage is designed to provide coverage when the app is in driver mode before you’ve received a ride request in the event your personal insurance does not respond. The policy has a $50,000 maximum limit per person, $100,000 maximum limit per accident, and a $25,000 maximum limit for property damage. There is no deductible under this policy. Note: This policy may be modified to comply with specific city or state insurance requirements.

Ride request accepted through the end of Lyft ride:

Our primary liability insurance is designed to act as the primary coverage from the time you accept a ride request until the time the ride has ended in the app. The policy has a $1,000,000 per accident limit. Note: If you already carry commercial insurance (or personal coverage providing specific coverage for ridesharing), Lyft’s policy will continue to be excess to your insurance coverage.

How does contingent collision coverage work?

Our contingent collision coverage is designed to cover physical damage to your vehicle resulting from an accident as long as you have obtained collision coverage on your personal automobile policy. The contingent collision coverage will apply up to the actual cash value of your vehicle or cost of repair, whichever is less. The policy has a $2,500 deductible. This policy is designed to step in regardless of whether or not you're at fault.

How does contingent comprehensive coverage work?

Similar to our contingent collision coverage, our contingent comprehensive coverage is designed to cover physical damage to your vehicle resulting from a non-collision event (for example a fire, vandalism, a natural disaster, etc.) as long as you have obtained comprehensive coverage on your personal automobile policy. The contingent comprehensive coverage will apply up to the actual cash value of your vehicle or cost of repair, whichever is less. The policy has a $2,500 deductible. This policy is designed to step in regardless of whether or not you're at fault.

What does UM/UIM mean and how does this coverage work?

UM stands for uninsured motorist and UIM stands for underinsured motorist. In the event of an accident (once you have accepted a ride or are transporting a passenger) with a driver who is uninsured or underinsured and is ultimately at fault for bodily injury caused to you and/or your passengers, our UM/UIM coverage will apply up to $1M per accident. There is no deductible on our UM/UIM policy.

When do these coverages apply?

It depends on the coverage. During the time the Lyft app is on and available to accept a request (also known as “driver mode”), the contingent liability policy is in effect. The other three coverages are in effect beginning when you’ve accepted a passenger ride request and are on your way to pick the passenger up. They continue while you’re giving a ride to a passenger and until you end the ride in the app.

What's covered through Lyft + Hertz Express Drive?

Lyft provides primary coverage from the time you log into the app and are available to receive requests up until you log out of driver mode. When the Lyft app is off, Hertz’s insurance policy (included in rental cost) provides Primary Auto liability coverage. Coverage for any physical damage to the rental vehicle is subject to a $2,500 deductible per accident. Check your rental agreement for details.

What's covered through Lyft + GM Express Drive?

Lyft provides primary coverage from the time you log into the app and are available to receive requests up until you log out of driver mode. When the Lyft app is off, GM's insurance policy (included in your rental cost) provides Primary Auto Liability coverage. GM also provides coverage for any physical damage to the vehicle for the entire rental period, including while using the Lyft app. The deductible is $1,000 per accident. Check your rental agreement for details.

What states are covered by this policy?

Our policy is available in all states in the U.S., except for those rides originating in New York City with a TLC (Taxi and Limousine Commission) driver. Some regions may have specific requirements that modify the described coverage.

We're committed to pushing the insurance industry to innovate quickly and create unique solutions for our drivers. Several personal auto insurers also offer different coverages available for transportation network drivers. Please contact your personal auto insurer for more information. If you have questions relating to insurance, let us know.